Thursday, 19 April 2012

Tired millionare

What if you become tired? What if your have no energy and have no motivation to do what you love. To focus on your strength and your ability to be successful. Your energy is depleted to unnecessary work. Your energy is wasted. What Should you do? What motivation left.

Wednesday, 18 April 2012

Can you become rich by investing in Forex?

We hear and see a lof of Forex Advertisment on Internet. They claim that you can become instant rich by investing in currency. It's not difficult to find and read about forex investment, forex tool and forex tutorial. It's true that some people make money one forex while other will lose money. It's possible to say that forex is cheat games, it's not real and it's manipulating other people wealth trough speculation. It's not wise to invest on something you can hold or you can't see. But for some people it's very profitable. There are many forex investment program. My advise is to start small and don't be greedy. I'ts look like a fun experience to see how many money you own or lose by looking at monitor chart screen. So enjoy and be careful. Be moderate and do it for experience and for fun. tq

Monday, 16 April 2012

‘Do it myself ’ mentality

Most of the houses he sold were worth about $2 million each.

Every time he closed a sale, he would earn a commission of 1%

or $20,000. Now, it took him roughly ten days of showing houses

to many prospects before someone eventually buys. This means

that each day is worth a potential $2,000! ($20,000 in commission

divided by 10 days).

Most real estate agents never become super rich because they

always have the ‘do it myself ’ mentality and dare not invest in

other people. But Dennis knew that if he were to hire an assistant

to do the paperwork and telemarketing, it would cost him salaries

of about $4,000 a month, or around $200 a day. However, if he

were to do all these tasks himself, he would save this $200 a day,

but it would cost him a potential loss of $2,000, as he would not

be able to spend this time showing houses! This would be a net

loss of $1,800!

How delegation can create more money?

Now among all my activities, which one do you think created the

most profi ts? The answer is when I was training. Every day I trained,

I earned for my business $5,000 (100 students multiplied by $50 per

student). However, because I had to do all the other activities, I only

had the time and energy to do a maximum of six training days a

month, thus the most I could gross was $30,000 a month.

I thought of hiring people to do the administration, logistics

and accounting but I was initially too stingy. I thought to myself,

‘If I hire an administrative assistant, I would have to pay the person

$2,000 a month’. ‘If I do it myself, then I would save the money!’.

What I did not realize then was that by doing the admin,

accounts, logistics and selling myself, I was actually losing money

everyday! Why?

You see, every day was worth a potential $5,000 if I spent it

doing training.

If I were to hire an administration assistant, I would have to

pay the person $2,000 a month, which works out to $100 a day

(assuming 20 working days a month). If I did the administration

work myself, I would save $100 a day. However, I would be losing

a potential $5,000 as I would not be able to be out training. So

although I save a potential $100, I lose a potential $5,000, I end up

losing $4,900!

The moment I realized this, I went out and hired an assistant to

take care of all my admin work like fi ling, answering calls, arranging

logistics, coordinating with clients and so on... This freed me of a

collective fi ve days a month which I could now spend doing training

and earning my business an additional $25,000 a month. Not bad, I

invested $2,000 to earn back $25,000!

Times equal money

When I talk about increasing the time you spend creating value,

I do not necessarily mean that you must work longer hours. Rather,

you must spend more of your time only on activities that create the

greatest value... that generate the most profi ts for your company.

Whether you are an entrepreneur or an employee, you will

have a list of things that you must do everyday as part of your

responsibility. You will fi nd that not all the things you do create

the same amount of value. There are some activities that create

high value while some activities are low in value. In fact, I have

discovered that most average income earners spend only about 20%

of their workday doing truly high value added activities while they

spend most of their time, about 80%, on low value activities like

checking email, attending unproductive meetings, chit chatting,

complaining, waiting, fi nding lost items... stuff that does not generate

profi ts or help clients meet their goals.

High-income earners are the opposite. They tend to spend 80% of

their time on high value added activities like business development,

closing sales, innovating new revenue streams, market strategizing,

following up with prospects, strategizing on how to improve

productivity, managing projects, getting feedback from clients...

stuff that lead to high customer satisfaction and higher profi ts!

How to increase business profit

Conversion rate (ctd)

22 Convenient payment scheme

(NETS, Credit card)

23 Offer installment schemes with

zero interest

24 Allow mail order/home delivery

25 Address concerns/possible

objections upfront

26 Sell on value not price

Number of Repeat Business

1 Direct mail offers of the month

2 Keep in touch every 3 months

3 Inform your clients of your entire

range of services

4 Target likely repeat customers

5 Send special occasion cards

6 Make customers feel special

(super experience)

7 Build a close relationship

8 Create a loyalty program

Average Dollar Purchase

1 Focus on a higher income

target market

2 Use a shopping list

3 Sell add-ons/up sizes

4 Make sure your client knows your

full range of services

5 Suggest most expensive fi rst

6 Create value packages

7 Buy three get one free deals

8 Ask people to buy some more

9 Increase prices by 10%

10 Arrange easy fi nance and payment

11 Free gift/lucky draw with

$xx purchase

Net Profi t Margins

1 Increase prices

2 Sell on value/service than

price/discounts

3 Set monthly budget targets

4 Track costs weekly and aim to

reduce by 10%

5 Stop running ads that don’t work

6 Sell more higher margin items

Leads

1 TV, Radio or Newspaper advertising

2 Industry newsletter advertising

3 Internet/email advertising

4 Magazine advertising

5 Outdoor advertising

6 Flyers

7 Hold a promotion or sale

8 Ask for referrals

9 Offer a free gift

10 Insert into other company’s invoice

11 Letterbox fl yers

12 Sales teams

13 Telemarketing

14 Buying or swapping database

15 Hold seminars, events or roadshows

16 Attractive window display/video

17 Posters and large signage

Conversion Rate

1 Defi ne your unique selling

proposition

2 Set sales targets

3 Have excellent customer service

4 Introduce yourself

5 Survey your past customers

6 Sell key benefi ts passionately

7 High quality in store

posters/brochures

8 In-store sales scripts

9 Act as a consultant/problem solver

10 Give a money back guarantee

11 Have a benefi ts/testimonials list

12 Give free bonuses that

increase value

13 Greet prospects and use their name

14 Learn closing techniques

15 Ask for the sale more than once

16 Personal grooming/high

dress standards

17 Video in store displays

18 Leave price to last

19 Study and prepare for objections

20 Have specialized knowledge about

your product & industry

21 Focus on the client’s needs and

emphasize benefi ts

Strategies to Increase Your Business Profi ts

How to increase profit margin?

Finally, how can you increase your company’s profi t margins? You can

- l Source for cheaper suppliers which are just as good

- l Bargain hard with existing suppliers

- l Sell higher margin products fi rst

- l Increase working effi ciency (do it right the fi rst time)

- l Strategize how to reduce unnecessary costs...

How to increase repeated customer?

What can you do to boost the number of times your customer keeps

coming back? Well, you can...

- l Exceed their expectations & give them a wonderful experience

- l Build a friendship with them

- l Keep in regular contact

- l Send them special occasion cards

- l Start a loyalty program

- l Give them a discount voucher off their next purchase...

Increasing Average Dollar Purchase

I gave you an example earlier on about the advertising account

director who was able to convince his clients to increase their

advertising budget. How? Because he showed them that by investing

an extra $300,000 in advertisements, they would be able to generate

$600,000 in additional profi ts. If you can show your clients that their

investment in your product will reap great returns, they will spend

more. So what can you do in your company? Maybe you can:

- l Bundle several products in a package

- l Create a ‘buy three get one free’ promotion

- l Up sell & cross sell

- l Educate your customers on your entire range of services

- l Do a complete needs-analysis to fi nd out how you can add even more value (remember the example I gave you about the insurance agent?)... and the list goes on.

How to increase Conversion Rate

How can you boost your company’s conversion rate? There are

many strategies you could use such as...

- l Creating a more flexible payment plan (0% interest installment)

- l Offer a product guarantee

- l Use successful testimonials

- l Create more persuasive marketing materials like brochures, videos

- l Use NLP* techniques to build strong rapport with clients

- l Innovate a new persuasive sales script that works

- l Create a more powerful, impressive & persuasive presentation

- l Keep following up with prospects regularly... and the list goes on

How to increase lead?

l Learn how to create more effective advertisements

(Stronger headlines, more persuasive copy, i.e. text)

l Test new media channels (e.g. Newspaper, magazine, outdoor

ads etc...)

l Make more cold calls

l Use telemarketing efforts

l Hold seminars & road shows

l Increase networking efforts

l Hold special promotions

l Create a referral system or member get member scheme

l Start email marketing... the list goes on

How to Double Your Company’s Profits in Less than Six Months

Many people have asked me, ‘what can I do to increase my company’s

sales and profi ts?’. Whether you are an entrepreneur or an employee,

I am going to share with you a formula that you can use to double

the profi ts of your department or company within less than six

months. I call this the Profi t Multiplication Formula.

In any kind of business, profi ts are only determined by fi ve

variables: Leads generated, conversion rate, average dollar purchase,

average repeat business and net profi t margins.

Leads represent the number of potential customers or prospects

that the company generates through walk-ins, inquiries, cold calls

& recommendations. Let’s say that out of every ten prospects, two

eventually end up buying, this means that the company’s average

conversion rate is 20%.

How do you create value?

There are only two ways you can create value for your clients.

Either:

1. Help them reach their goals faster and more easily or

2. Help them solve their problems faster and more easily.

Either:

1. Help them reach their goals faster and more easily or

2. Help them solve their problems faster and more easily.

What some peole are rich and some are not?

Your Income is A Refection

of the Value You Create

Let’s fi rst focus on how your income is determined by the value

you create. Well, let me give you a metaphor. Recently I went to the

mall to buy a new mobile phone. When I found the mobile phone

shop, I saw all kinds of brands and models on display – the price tags

they carried all differed widely. I saw a Sony Ericsson 910i model

that had a price tag of $1,400 and a Nokia 2600 with a price tag of

$238. Now, why is one mobile phone priced seven times more than

another? The answer is simple. It’s because one phone has a lot more

functions and can hence create a lot more value to the user.

The Sony Ericsson 910i is able to make calls, send & receive

SMS, send & receive MMS, record and edit videos, play & edit

music, take high quality pictures, surf the internet, entertain with

games, send and receive emails, has word processing and spreadsheet

capabilities, has Bluetooth technology and has an in-built personal

digital assistant. In short, it is not just a phone, it is a mini computer!

It does a lot more than expected (remember millionaire habit 1).

It creates a lot more value for the user by allowing him to achieve

his goals more effi ciently.

So let me ask you a question. Which mobile phone do you

represent? What is the price tag that you carry? If you want to have

a higher price tag and have people pay for you, then you must create

the necessary value!

What allows the Sony Ericsson 910i to create so much more

value? The answer is that it has a lot more software installed. How

does this translate to you? Well, in order for you to create a lot more

value to your company and your clients, you must keep upgrading

your knowledge and skills, your intellectual capital!

How to create financial plan?

As you can see, different cash fl ow assets give you different rates

of returns and while some require lots of capital, others require

mainly the investment of time and ideas. For example, if you were

to rely purely on high yielding bonds of 8% return, you will need

$600,000 to generate $48,000 a year ($48,000 ÷ 8%) in passive

income (i.e. $4,000 a month). If you were to create a home-based

Internet business, a $2,300 investment could through time and hard

work, generate you a monthly $4,000 cash fl ow. Stay tuned on how

you can possibly do this in the coming section on ‘Creating Multiple

Streams of Income Online’.

Simple tips to become millionare

Spend Less than You Earn. Invest the Savings for COMPOUND GROWTH Until You Accumulate a Portfolio of POSITIVE CASH FLOW ASSETS that Generate Enough Cash Flow to Sustain or Exceed Your DESIRED LIFESTYLE.

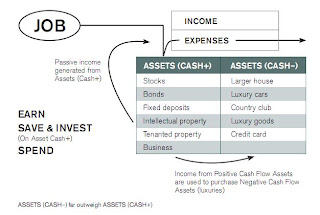

Rich Cash Flow

So how do the rich manage their money? How do they achieve

a level of wealth where they do not have to work if they choose not

to? Those with the wealthy mindset adopt a ‘earn, save and spend’

habit of managing their cash. They set a specifi c target of how much

they want to save every month, usually 15%-20%. They deduct this

savings from the income they earn and spend the rest.

Unlike those with the ‘middle class mentality’, the rich mindset

motivates them to take their savings and invest in Positive Cash Flow

Assets that will generate returns and appreciate in value. They would

rather put their money in carefully selected stocks, mutual funds

and businesses than to splurge on the latest LCD Plasma Television.

Although they may buy a few luxuries to pamper themselves,

their Positive cash fl ow assets far outweigh their Negative Cash

Flow Assets. As a result, the additional passive income generated

from their investments outweighs whatever expenses they incur on

these ‘extras’.

How to become millionaire with money

In the New York Times Best-Selling book ‘The Millionaire Next

Door’, Thomas J. Stanley interviewed 300 self-made American

millionaires to fi nd out how they think, how they earn their money

and how they spend their wealth. What he discovered was a shocking

revelation that made his book an instant best-seller.

It was discovered that many people who had high paying jobs,

drove the latest luxury cars and wore the latest designer clothes

and who appeared to be have millions to spend, were usually broke

with a low personal net worth. Most of these professionals and

senior executives of multi-national companies were what he termed

‘Under Accumulators of Wealth (UAW)’.

In contrast, those who were actual millionaires (that is those

with a net worth of over US$1 million) lived very frugally and

well below their means. Eighty-percent of them were born poor or

from middle class families. They wore inexpensive suits and never

bought a watch that cost more than S$500. Most of them drove

secondhand cars, never bought the latest models of vehicles and they

usually invested a minimum of 20% of their income in the stock

market or private businesses. He termed these people ‘Prodigious

Accumulators of Wealth (PAW)’.

I must admit that when I was much younger, I too had the same

distorted beliefs about how real millionaires lived. When I was a

kid, I used to admire and envy people who drove the latest Porsche

Boxsters and who lived in Penthouses and lived lavish lifestyles. My

millionaire Dad (who never bought a brand new car in his life until

he turned 50), used to tell me that these people were in reality quite

broke and it was really the bank who owned their houses and their

fl eet of cars. He said that they were one paycheck away from going

broke. I never really understood what he meant until much later on

in my life.

Common Negative Beliefs & Associations About Money

After conducting this exercise with thousands of people in different

countries, I have found the following common negative associations

consistently being revealed. Do you share any of them?

- l Money is the ‘root of all evil’

- l Money will make you materialistic

- l Money will make you less spiritual

- l If I became wealthy, I will lose all my friends

- l Money doesn’t grow on trees

- l Rich people are greedy and selfi sh

- l Rich people are stingy

- l To get rich, you must be lucky, dishonest or really smart

- l Money will not buy you happiness

- l Money isn’t that important anyway

- l To have more money, I will be depriving others of it

- l If God wanted us to have money, he would give it to us

Millionaire Habit 9: Respect & Love Money

The fi nal and one of the most important wealth habits is to respect

and love money. I don’t mean loving money to the extent that you

are a slave to it, but loving money for the good it can do for you and

the people around you.

Most people I share this with often respond by saying, ‘Well,

of course I love money! Of course I respect money.’ Who doesn’t?

If I didn’t love money for what it can do, I wouldn’t be reading

this book.

Well there are many people who consciously desire to be rich and

know that money is important. However, at a deeper level they may

not realize that their subconscious mind either holds many limiting

beliefs about money or associate lots of negative feelings towards

money. These negative associations cause them to repel money and

prevent them from becoming rich without even realizing it.

I remember a time when I gave a seminar to a group of teenagers

nd I was teaching them about the power of spotting opportunities

nd taking action on them. I took out a $10 bill and said that I was

elling it for $2. I waved the bill in my hand for a good 10 minutes

sking if there were any takers, but none came up. Eventually, one boy

hesitantly came up and took the money. ‘Buying this $10 note for

$2 represents a great profi t opportunity, so why didn’t any of you

come up?’ I asked. The answers I got were: ‘I didn’t want people to

think I was money-faced’, ‘I did not want to cheat you of your money’,

‘I thought it must be a trick’. In other words, what prevented them from

taking action on any opportunity were the

limiting beliefs and associations they had formed about money.

The scary thing is that the same thing happens in life! Why is it

that some people see and act on money making opportunities

everyday while others just don’t see them? Again, it is because of

the beliefs that have been formed in their subconscious mind.

Millionaire Habit 8: The Ability to Turn Failure into Success

The fi nal millionaire habit is the ability to accept failure and to

turn it into success. Most people have the impression that successful

people never fail and that millionaires never lose money. As a result,

many people fear failure and shun those who have fl opped. This is a

huge lie and distortion that prevents people from becoming rich.

The truth is that everybody fails at one point or another. In fact,

millionaires fail more times than anybody else because they take so

much more action. I have made countless stupid mistakes, lost a lot

of money and have failed so often that I have lost count. So mark

my words, you will fail many times before you ever succeed. What’s

important is what you do about failure. This is the critical habit that

makes the difference between the rich and the poor.

There are three ways people respond to failure. The fi rst group

of people get so disappointed by their failure that they just give up!

They would say, ‘I tried it but I failed’ or ‘I tried investing but it didn’t

How do I know if I am truly passionate about something?

Whenever I teach this in my seminars, people will always have

two more questions for me. The fi rst question is, ‘How do I know if

I am truly passionate about something?’ To fi nd the answer, just ask

yourself this question, ‘If I had all the money in the world, would

I still be in this career/business?’ If the answer is ‘yes’, then it is truly

your passion. If the answer is ‘no’, then you are defi nitely in the

wrong industry. In fact, when I had the opportunity to interview

the top insurance advisors in Singapore (I specialize in insurance

sales training), I found that those who were highly successful,

earning over $500,000 a year, had one thing in common.

Millionaire Habit 5: Do What You Love

The most common question that people ask me about getting rich

is, ‘what is the best career or business that will make me the most

money?’ Should I go into education? Food? Insurance? Network

marketing? Heathcare? Options trading? Property? What’s the best

industry to be in right now?

Well, you will fi nd that in ANY industry, there will be a

minority who will be making plenty of money, while the majority

will be struggling to survive. You hear stories of insurance agents

earning $600,000 to $1 million a year (many of them are my

personal friends). Again, this is the minority. The majority will be

just making enough to get by. Many people see me in the children’s

education business making millions and think that it’s a lucrative

business. Again, what they don’t know is that I am in the minority.

The majority of businesses in education are struggling to survive. So

my answer to that question is that you can become a millionaire in

ANY INDUSTRY, only if you are one of the best! If you are not

one of the best, you will never become rich in ANY industry.

You CAN become a millionaire in insurance, property, options

trading, children’s education, pest-control, retail, food or Internet

marketing ONLY when you are one of the best. So, how do you

become the best in the market? The answer is by being totally,

absolutely one hundred percent committed towards your particular

career or business. People become the best at what they do only

because they eat, sleep, breathe, talk and think their business

eighteen hours a day (sometimes, they even dream about it as they

sleep). In other words, they are obsessed with doing what they do

and are constantly fi nding ways to do it better. And the only way

you can become totally obsessed and committed towards something

is when you have a love and passion for it!

Millionaire Habit 3: Take 100% Responsibility

As this wealth habit has already been introduced and explained

in the earlier chapter, I am just going to just mention it briefl y.

Wealth habit number three is the habit of taking responsibility

for your results and wealth! Unfortunately most people choose

to adopt the victim’s mindset of giving excuses, blaming and

complaining. Remember when you give excuses to yourself

(i.e. no time, no luck, no capital, no experience, etc...) or blame

others for your lack of wealth, then you are putting others and

external events in control of your life! When you are not in control,

you do not have the power to change your circumstances.

Instead, millionaires take 100% responsibility for their wealth.

They believe that they alone create their wealth through their

strategies and actions. As a result, they know that they have the

power to change their wealth by changing their strategies and

actions. It is only when you live by this habit will you have the

power to exponentially multiply your income and wealth.

Millionare mindset 2: Be proactive

People who are

proactive are people who take the initiative to make things happen.

When there are no opportunities, proactive people are those that go

out and fi nd opportunities. If they cannot fi nd any, they will create

their own opportunities. When problems get in their way, proactive

people will take action to solve their own problems!

On the other hand, there would always be an even larger number

of people who will just stand around and wait for others to come

and shake their hand. These people exhibit the reactive mindset.

People with the reactive mindset have the habit of waiting for

things to happen to them. They tend to act only in reaction to

others’ actions. As a result, they have a lot less control and choices

over results that affect them. When no opportunities present

themselves, reactive people just sit and wait for the opportunities

to come to them.

Why 90% business failed?

As an entrepreneur today, you must do a lot more than expected

in order to run a successful business and create wealth! In the past

economies were a lot less competitive. In the past, when a business

performed below customer’s expectations, they would be struggling

to break even. If a business met their customer’s expectations, they

would make good profi ts. If a business exceeded their customer’

expectations, they would become a market leader and would earn

huge profi ts!

Why do over 90% of businesses fail today? It’s because markets

have become so much more competitive. If you start a retail store

you are competing with hundreds of others, both locally and

internationally! Today, if you perform below customer’s expectations

customers will never come back and you will go bust! Today, i

you meet customer expectations, you will still be struggling to

survive! Why?

This is because hundreds of other businesses can also meet your

client’s expectations, and some of them do so at half your cost. You

will fi nd that you will be competing on price most of the time and

will earn so little that it is hardly worth your while. I have seen

so many business owners struggling to break even simply because

what they offer is the same as every other business in their industry

In today’s marketplace, if you exceed your client’s expectations

you will only earn nominal profi ts because many businesses already

do their best to add more value to their clients.

So how do you make huge profi ts and become a millionaire

in business today? The answer is that you have to go way beyond

your client’s expectations. You have to give them an unbelievable

experience where they will keep coming back to your business and

tell all their friends about you. You must set your standards so high

that they will never go to anyone else for that particular product

or service. When you highly exceed your client’s expectations, you

can charge a premium and make huge profi ts. This has been my

secret of success for all my businesses and I want you to learn this

same secret right now!

Why millionare is a value creator?

It is not something you are born with, it has got nothing to do with

your academic qualifi cations but it is a habit of choice that anyone

can adopt. Value creators have the habit of doing a lot more than

expected. If they are paid $3,000, they will work as if they are being

paid $20,000. If they are expected to generate $10,000 worth of

profi ts, they will create $30,000 worth of value! They are called

value creators because they create value for companies. It is through

their efforts, that the company makes more and more profi ts every

year. As a result, their income is not considered an expense to the

company, but a great investment.

Even in periods of downturns, when everyone else is getting

retrenched and pay cuts, they get pay increases, bonuses and stock

options. The company knows that for every dollar they invest in

them, they will return triple the value. These people are the high

fl yers who get promoted super fast and get their incomes doubling

and tripling in a few years.

In the past, income was based mainly on seniority and loyalty.

The longer you stayed, the more you were valued. In today’s world,

income is based entirely on the amount of value you can create. It is

not uncommon to see people who are much younger, with a lot less

experience directing businesses and earning lots more than senior

workers who have been with the company a lot longer.

Value creators are indispensable assets to their company! They

are very hard to replace. And that is why companies will pay them

more and more and offer them partnerships to retain them. Value

creators are never out of a good job. They are usually head hunted

by other companies all the time, the head hunters offering to double

their income if they join them. So, the fi rst unbreakable habit of

wealth is to do a lot more than expected. In chapter 6, you will

learn specifi cally about how to create massive value that will lead to

massive income!

What is Millionaire Habit 1

Always Exceed Expectations

Before I explain what this first habit means, I want you to list down

in the spaces below, at least fi ve reasons why becoming rich is

important to you. Why do you want to make more money? Is it

to provide your children with the best education, to have peace

of mind or to have the freedom to travel round the world? Unless

you know WHY you want to be rich, you will never have the

passion to go for it. Take as much time as you need to list down

the reasons

DO MORE THAN EXPECTED

Create Value

DO EXACTLY AS EXPECTED

Sustain Value

DO LESS THAN EXPECTED

Reduce Value

Indispensable Asset & High Return

Investment to the Company

Dispensable Asset & Low Return

Investment to the Company

Liability & Expense to the Company

How to protect your million dollar?

There is no use working hard to build your personal fortune only

to see it all taken away from you. There are many people who have

taken decades to build their fortune only to see it wiped out by

an accident, unforeseen illness or through an unexpected lawsuit.

Self-made millionaires engage professionals like insurance advisors,

lawyers and accountants to help them build a fi nancial fortress so

their wealth is protected from potential creditors, plaintiffs looking

to sue and the government who may take away a big chunk of your

wealth through a whole range of taxes that you may not have even

heard about.

How to grow money to a million level

By increasing your income and reducing your expenses, you will

fi nd that you will be able to accumulate a surplus of funds that

you can use to help you build your fortune. You need to do this

because, no matter how hard you work and save, you will never be

able to create phenomenal wealth unless you learn how to put your

money to work for you. Through the power of compounding, you

will be able to take small sums of money and build it into huge

returns over time.

All self-made millionaires attribute a huge part of their wealth to

their investments because they know that just working for money

will never make them rich. It is when you allow your money to

make you money that substantial wealth can be created.

If you’ve had the bad experience of losing money in stocks and

mutual funds and resigned yourself to believing that the only safe

way to invest is to put your money in the bank and get 3% returns,

don’t worry. The strategies that I will be sharing carry minimal risk.

Remember self-made millionaires are shrewd risk takers and this is

very different from being gamblers.

How to manage income

Many people think that by increasing their income, their wealth

will automatically increase. Unfortunately, increasing income is only

one side of the wealth equation. After all, there are people who

earn $2,000 a month who are broke and there are those who earn

$20,000 who are still broke. The reason is because when we don’t

manage the money we earn, our expenses will always rise to our

level of income, wiping out any surplus we have! Or worse, we start

spending on credit lured by easy repayment schemes. Millionaires

become rich not because of how much they earn, but rather how

much they are able to save and invest.

Why most people never achieve their financial dreams?

Most people never achieve their financial dreams simply because

they have no fi nancial plans and haven’t got a clue as to how to

create one. They just work hard and hope that everything will be

okay one day. You cannot leave your fi nancial future to chance,

you have got to plan for it. While there are great fi nancial planners

around who can give you some sound advice, you must ultimately

take responsibility and develop your own plan! After all, it is your

life we are talking about.

What is millionaire mindset?

First, learn and adopt the mindset of a millionaire. Millionaires

think very differently and that is why they take different actions

and produce vastly different results. Self-made millionaires have a

different set of beliefs and habits that allow them to see opportunities

where others see problems.

Millionaires see learning experiences, where Mister Ordinary

sees failure. The moment you adopt the beliefs and habits of a

millionaire, your perception of the world will change completely

and you will realize that there are money-making opportunities

everywhere and everyday around you.

Amazingly, these are opportunities that you were once quite

blind to!

How to win Money Game?

You see... making money is a game. If you learn the rules of this game, money will ? ow into your hands. If you do not play by the rules, you will struggle all your life ? nancially despite working very hard. Haven’t you ever asked yourself why some people earn ? ve times, ten times or even twenty times more than others? Is it because they are twenty times smarter? Is it because they work twenty times harder? Or are they many times luckier? The answer to all these questions is a resounding ‘NO’! I am sure you know people who seemed to be much lazier than you in school and had poorer grades but now they are so much more successful ? nancially. Although their school report card used to be chockfull of ‘F’s, their ? nancial report card carries straight ‘A’s. Why? The only reason is because they know how to play the game of money whereas most people have not learnt how the game is played. You see... none of us are ever taught how to make money, how to invest money or how to manage our wealth and yet money is the most important subject in our adult lives. Although many people say that ‘money isn’t everything’, that’s only a half-truth. The truth is that ‘everything is money’! In order to achieve excellence in the different areas of lives like our health, relationships and family, we need to be ? nancially secure!

To be financially secure means to be ‘Free’ – free from being hounded by creditors to pay one’s rent or the hospital to pay one’s bill. To have suffi cient money to feed oneself and one’s family, to pay for basic needs and to pamper ourselves with luxuries once in a while. It also means the ‘freedom’ to walk away from a job, a company, an employer, one cannot stand and have the option to be employed or self-employed doing something one values and finds fulfilling. No one can quarrel with this defi nition of the need to

have enough money.

To be financially secure means to be ‘Free’ – free from being hounded by creditors to pay one’s rent or the hospital to pay one’s bill. To have suffi cient money to feed oneself and one’s family, to pay for basic needs and to pamper ourselves with luxuries once in a while. It also means the ‘freedom’ to walk away from a job, a company, an employer, one cannot stand and have the option to be employed or self-employed doing something one values and finds fulfilling. No one can quarrel with this defi nition of the need to

have enough money.

What the Greatest Money Making Asset That Will Make You A Fortune

So what is this one asset that all of us already have at our disposal? No, it’s not your double degree, MBA or PhD. from the best universities. And no, it’s not the inheritance the ‘lucky’ get from rich dad, rich uncle or rich grandma to kick-start their business. No, this asset is so powerful that it will not just give you a 4% return like the bank or even a 20% return which you would expect from the stock market. This asset has the potential to give you in? nite returns. In fact, it can, if passionately developed, give you a 1000% return on your time investment.

This asset is your mind, also known as your intellectual asset! When you invest time and money to expand your knowledge and skills, especially your ? nancial education, it will return you millions of dollars in income streams for the rest of your life! And that is exactly the purpose of this book, to massively increase the power of your intellectual asset.

Subscribe to:

Comments (Atom)